Employer Sponsored Retirement Plans

Why should you set up a retirement plan, and what are some of the benefits?

A retirement plan has lots of benefits for you, your business and your employees. Retirement plans allow you to invest now for financial security when you and your employees retire. As a bonus, you and your employees get significant tax advantages and other incentives.

According to the IRS, did you know…

- that retirement can last for 30 years or more?

- you may need up to 80% of your current annual income to retire comfortably?

- the average monthly benefit paid by the Social Security Administration is $1,200?

We’re here to help guide you through this important decision and as independent fiduciaries, we take your individual circumstances and create a successful plan for you or your business.

RETIREMENT PLANNING FOR BUSINESS OWNERS

We understand what you’re looking for:

» LESS WORK» LOWER COSTS» LESS FIDUCIARY RISK / REMAIN COMPLIANT» SUPERIOR EDUCATION FOR PARTICIPANTS

“One size fits all” does not apply to retirement plan providers and sponsors. Every business has its own unique intricacies that dictate which provider will best suit them. That’s where a true independent retirement plan advisor can help you when considering the pro’s and con’s of each provider.

TOP REASONS TO SPONSOR A RETIREMENT PLAN:

» Improve Employee Motivation & Company Morale

» Create A Successful Compensation Package

» Take Advantage Of Recent Tax Credit Increases For Plan Sponsors

» Graceful Transition In Workforce Turnover

» Tax Shelter For Business Owners

» Tax Deferred Growth

» Financial Security & Credit Protection For Business Owners

» Social Responsibility / Consciousness / Public Relations

SERVICES TAILORED TO YOUR NEEDS

BENCHMARKING

We can show you how your plan stacks up against its peers when it comes to fees, performance, and participation rates. Our team is unbiased; they will present to you a variety of highly reputable providers that fit your company’s goals and objectives specifically.

FIDUCIARY SOLUTIONS

The DOL has deemed all plan fiduciaries are personally liable for ERISA violations that cause plan losses. Now, more than ever, it is important to be aware of and understand your fiduciary responsibilities. We will educate you and keep you informed!

EDUCATION

We provide training workshops and webinars for all of your participants, giving them personal insight into how their plan works, how they can make changes, and what they can expect.

PLAN MONITORING

We will meet periodically with the plan’s management committee to assess whether the plan is performing as expected, as well as provide access to regular plan performance reports. Emphasis is placed on keeping up to date with Employment Retirement Income Security Act (ERISA) and Department of Labor (DOL) regulations, and effecting any necessary changes in order to stay compliant.

RETIREMENT PLANNING FOR EMPLOYEES

Does your employer offer a Sponsored Retirement Plan?

Did you know that according to a recent survey by Charles Schwab only 25% of people have a financial plan and that 60% of people live paycheck to paycheck? To have a comfortable, secure—and fun—retirement, you need to build the financial cushion that will fund it all.

If your company sponsors a Retirement Plan benefit, make sure to educate yourself as to why it can be prudent to join the plan and begin saving for your future.

For much of the 20th century, retirement in America was traditionally defined in terms of its relationship to participation in the active work force. An individual would work full-time until a certain age, and then leave employment to spend a few years quietly rocking on the front porch. Declining health often made retirement short and unpleasant. Retirement planning, as such, typically focused on saving enough to guarantee minimal survival for a relatively brief period of time.

More recently, however, many individuals are beginning to recognize that for a number of reasons, this traditional view of retirement is no longer accurate. Some individuals, for example, are voluntarily choosing to retire early, in their 40s or 50s. Others, because they enjoy working, choose to remain employed well past the traditional retirement age of 65. And, many retirees do more than just rock on the front porch. Retirement is now often defined by activities such as travel, returning to school, volunteer work, or the pursuit of favorite hobbies or sports.

This changed the face of retirement, however, with all of its possibilities, does not happen automatically. Many of the issues associated with retirement, such as ill health, and the need to provide income, still exist. With proper planning, however, these needs can be met.

SEEK PROFESSIONAL GUIDANCE

Developing a successful retirement plan involves carefully considering a wide range of issues and potential problems. Finding solutions to these questions often requires both personal education and the guidance of knowledgeable individuals, from many professional disciplines. The key is to begin planning as early as possible.

Social Security accounts for only 33% of income for people 65 and over

Factors That Help You Be Prepared

Take the Match: Many employers offer a matching contribution to your retirement plan contributions. This is a huge benefit to you, as it will dramatically accelerate your retirement savings.

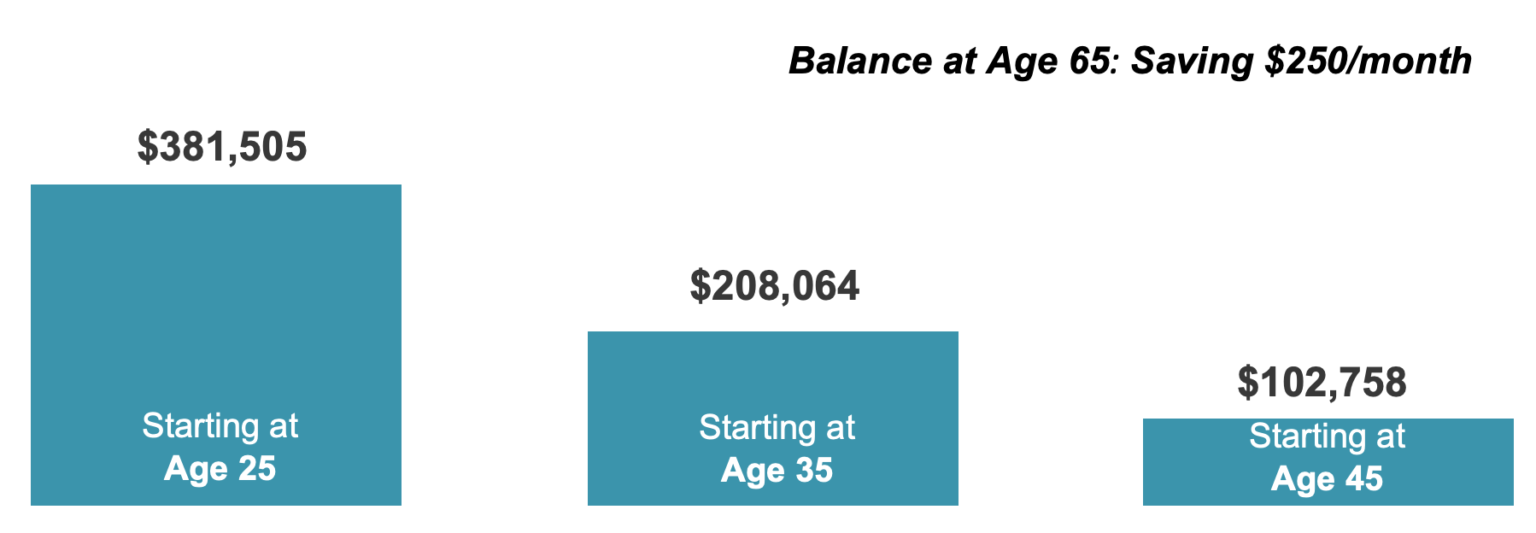

Start Early: Three factors determine what your retirement investment will be worth- amount invested, rate of return, and duration of investment. Starting early lets you invest less each week to reach the same goal over time, but its never too late to start! Start Now!

Assuming a 5% rate of return, a $250 monthly contribution and monthly compounding to the age of 65. The hypothetical example above is based on a mathematical principle and represents no particular investment. There is no guarantee these results will be achieved. It is used for illustrative purposes only. There are risks associated with investing, including but not limited to, loss of principle.

Know Your Potential Sources of Income

Will Social Security Be Available?: Social Security accounts for only 33% of income for people 65 and over in 2018 By 2034, Social Security may not be able to meet all of its obligations according to the Social Security Board of Trustees. Notably, the 401(K) retirement plan legislation that was adopted in 1978, was to encourage retirement savings, and NOT rely on Social Security.

Health care: The health benefits provided through the federal government’s Medicare program are generally considered to be only a foundation. Often a supplemental Medigap policy is needed, as is a long-term care policy, to provide needed benefits not available through Medicare. Health care planning should also consider a health care proxy, allowing someone else to make medical decisions when an individual is temporarily incapacitated, as well as a living will that expresses an individual’s wishes when no hope of recovery is possible.

Lifestyle

Some individuals, accustomed to a busy work life, find it difficult to enjoy the freedom offered by retirement. Planning ahead can make this transition easier.

Housing

This question involves not only the size and type of home (condo, house, shared housing, assisted living), but also its location. Such factors as climate and proximity to close family members and medical care are often important. Completely paying off a home loan can reduce monthly income needs. A reverse mortgage may provide additional monthly income.

Estate Planning

Retirement planning inevitably must consider what happens to an individual’s assets after retirement is over. Estate planning should ensure not only that assets are transferred to the individuals or organizations chosen by the owner, but also that the transfer is done with the least amount of tax.

Paying for retirement

Providing a steady income is often the key problem involved in retirement planning. Longer life spans raise the issue of the impact of inflation on fixed dollar payments, as well as the possibility of outliving accumulated personal savings. Social Security retirement benefits and income from employer-sponsored retirement plans typically provide only a portion of the total income required. If income is insufficient, a retiree may be forced to either continue working, or face a reduced standard of living.

Health Care

The health benefits provided through the federal government’s Medicare program are generally considered to be only a foundation. Often a supplemental Medigap policy is needed, as is a long-term care policy, to provide needed benefits not available through Medicare. Health care planning should also consider a health care proxy, allowing someone else to make medical decisions when an individual is temporarily incapacitated, as well as a living will that expresses an individual’s wishes when no hope of recovery is possible.

WHY WE USE THE RISK NUMBER TECHNOLOGY

Our Core Values

THOUGHTFUL INDEPENDENT FIDUCIARIES

Our clients have placed us in a position of trust and we take that duty seriously. As fiduciaries for our clients, it means we follow a high fiduciary standard of care that requires us to put your interests above our own.

YOU CAN TRUST THAT WE WILL ALWAYS:

- Act in your best interest

- Be transparent about costs and fees associated with our services

- Disclose any conflicts of interest that may be present when providing recommendations

- Help you understand all of the options available to you

- Provide prudent investment advice

- Avoid high cost or high commission products

- Be truthful with you about the risks you take when investing

If you are worried that the advisor you are currently working with may not be acting in your best interest, schedule a meeting with us and get a second opinion. The initial consultation is complimentary and it may help put your mind at ease.