Peace of mind starts with a plan built around your future goals and guiding values. That’s why we use RightCapital one of the industry’s most advanced financial planning platforms to bring clarity, confidence and flexbility to every stage of your financial journey.

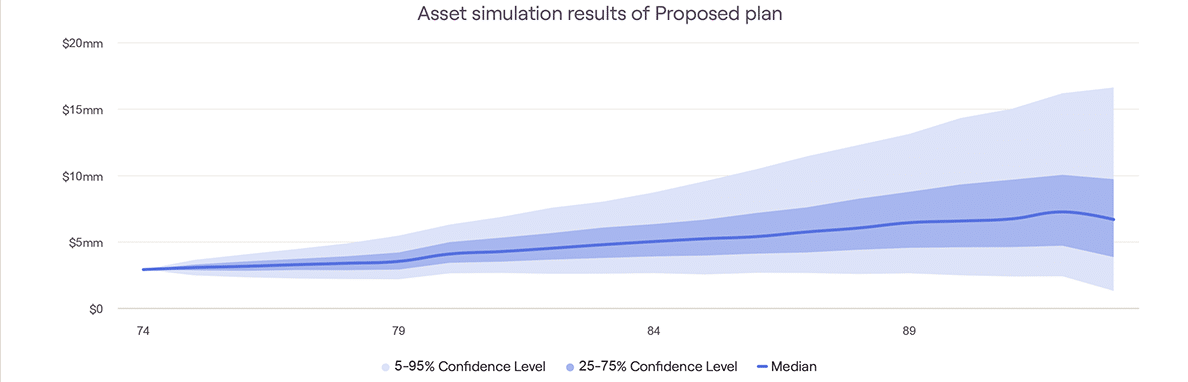

It models your financial future in real time, adjusting for life events, market shifts or new goals that may arise. Whether you’re considering retiring early, purchasing a vacation home, or funding education goals, we can instantly show you how it all fits together. It’s not just numbers -- it’s your life visualized, thanks to the RightCapital app.